Your ultimate guide to the best Travel Insurance Turkey.

Travel Insurance Turkey is an essential aspect of planning any trip to this beautiful and diverse country. Whether you’re heading to explore the rich history, ancient landmarks, stunning beaches, or indulging in the vibrant nightlife, having the right coverage can ensure your peace of mind.

Turkey is a country full of adventure, with everything from relaxing in national parks to taking part in thrilling adventure tourism activities. However, like any trip abroad, there are risks involved—whether it’s an unexpected medical emergency, trip delays, or the loss of personal belongings.

Travel insurance provides essential protection, allowing you to enjoy your vacation with confidence. In this guide, we will dive into the various types of travel insurance policies available in Turkey, how to choose the right one, and why securing Travel Insurance Turkey is vital for all travelers.

Understanding Travel Insurance

What is Travel Insurance?

Travel insurance is designed to protect travelers against unforeseen circumstances that could disrupt their trips. It covers a range of potential issues, from medical emergencies to lost luggage, and even cancellations due to unforeseen events.

Travel Insurance Turkey offers specific protection that accounts for the unique risks associated with visiting Turkey—whether you’re in the bustling streets of Istanbul or hiking through the scenic mountains.

With unpredictable weather, fluctuating climates, and the sheer variety of activities available, securing the right insurance gives you the freedom to enjoy everything this country offers.

Why Do You Need Travel Insurance for Turkey?

Traveling to Turkey can be a dream come true, whether it’s exploring the ruins of Ephesus, discovering hidden gems through walking tours, or unwinding on a Turkish Riviera beach. However, like any international destination, Turkey presents potential risks.

Medical emergencies, cancellations due to flight disruptions, theft, or lost luggage can easily disrupt your travels. With Travel Insurance Turkey, you are safeguarded from unexpected expenses.

For example, if you fall ill or get injured while enjoying outdoor activities or experiencing Turkey’s famous nightlife, the right insurance ensures you’re not burdened with overwhelming medical bills.

What Does Travel Insurance Cover?

Typical coverage includes medical expenses, lost or delayed luggage, trip cancellations, and travel interruptions. More specifically:

- Medical Emergencies: Health coverage is especially important when traveling in foreign countries. Whether you need treatment after a hiking accident in a national park or urgent medical assistance in a busy city, medical insurance ensures you’re protected.

- Trip Cancellations or Interruptions: Sometimes, life happens, and you may need to cancel or cut your trip short due to unforeseen events, such as personal emergencies or inclement weather. With Travel Insurance Turkey, you are reimbursed for non-refundable trip costs.

- Lost Luggage: If your luggage is lost or stolen, insurance can reimburse you for your items, whether they’re valuable electronics, souvenirs, or your clothes.

Tom, Lead Clinic

Researcher and Writer

Hi there! My name is Tom and I’ve been living in Turkey for almost a decade. Besides advocating the medical tourism industry in Turkey I also love to share my travel tips for Turkey. I know all the hidden gems and best ways to enjoy Turkey.

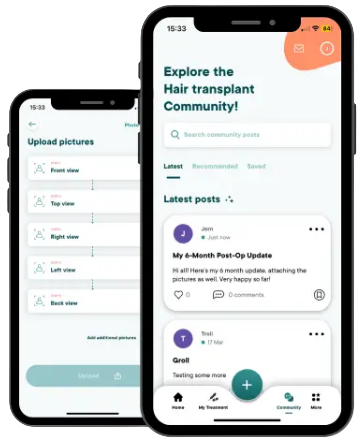

While you’re here – did you know that almost 60% of all hair transplants each year happen in Turkey?

Learn all about getting a hair transplant in Turkey including female hair transplants on my dedicated pages.

Types of Travel Insurance Policies Available in Turkey

Single Trip vs. Annual Multi-Trip Insurance

When considering Travel Insurance Turkey, travelers often have to decide between a single-trip policy or an annual multi-trip plan. A single-trip policy provides coverage for one trip, while an annual multi-trip policy offers coverage for multiple trips over a year.

For someone who plans to visit Turkey once, the single-trip option might be sufficient. However, if you’re planning on multiple visits, such as an extended stay or repeated trips for activities like walking tours or exploring new areas of the country, an annual plan can be a better choice.

This could be particularly cost-effective and convenient for frequent travelers.

Medical Travel Insurance

Whether you are in Istanbul, Antalya, or any of Turkey’s diverse regions, medical insurance is essential. Turkey’s healthcare system provides good services for tourists, but having Travel Insurance Turkey guarantees that you’re covered in case of accidents or medical emergencies.

From a minor injury while enjoying adventure tourism to a more serious illness, medical coverage is crucial. Make sure your plan includes emergency medical evacuation and repatriation, as healthcare may be expensive for international travelers.

Trip Cancellation and Interruption Insurance

Plans for cancellation and interruption insurance ensure that if unforeseen circumstances arise, you won’t lose your trip expenses. Flight delays due to weather changes, which are not uncommon in Turkey’s climates, or personal emergencies can lead to trip cancellations or interruptions.

With this type of insurance, you can recover non-refundable costs, such as accommodation and prepaid tickets. It also protects you if you need to cut your trip short and return home early, allowing you to claim compensation for unused bookings.

Baggage and Personal Belongings Insurance

Travel insurance also offers protection for your personal belongings. While exploring Turkey, whether on a walking tour through the streets of ancient cities or shopping for souvenirs, the last thing you want to worry about is losing your luggage or belongings.

Travel Insurance Turkey covers lost, damaged, or stolen items, so you’re not financially burdened. This is particularly important if you’re bringing valuables or expensive items like cameras or electronics, which can be vital for capturing your Turkish adventure.

Adventure & Activity Insurance

Turkey is famous for its adventure tourism opportunities—whether it’s hiking in Cappadocia, exploring the Lycian Way, or participating in extreme sports like paragliding or diving along the Mediterranean coast. If you’re planning any outdoor adventures, having the right coverage is crucial.

Travel Insurance Turkey should specifically include adventure and activity insurance, covering risks related to these activities. It can help cover medical expenses if you’re injured while trekking or accidents while exploring Turkey’s rugged terrain.

COVID-19 Travel Insurance

In the post-pandemic world, it’s essential to consider COVID-related insurance.

The global health situation continues to impact travel plans, and Travel Insurance Turkey may offer coverage for situations such as quarantine expenses, cancellations due to travel restrictions, or medical expenses if you test positive while traveling.

Ensure your policy addresses COVID-19 coverage before booking your trip to avoid surprises.

Travel Insurance Requirements in Turkey

Visa Requirements and Insurance

While Travel Insurance Turkey is not mandatory for entry into the country, certain visa types, especially for tourists planning extended stays, may require proof of insurance.

For example, if you’re traveling for specific purposes, such as joining a guided walking tour, or participating in cultural exchange programs, Turkish visa requirements may include insurance coverage for health, emergency evacuation, and repatriation.

Ensuring you have the appropriate insurance is not only beneficial for your well-being but also ensures compliance with visa requirements.

Insurance for Tourists in Turkey

Although travel insurance is not legally required for all tourists visiting Turkey, it is highly recommended by both the Turkish government and various travel agencies. Turkey’s Ministry of Health recommends that all travelers secure health insurance that covers medical emergencies while in the country.

This is particularly important for travelers engaging in activities that carry risk, such as participating in adventure tourism activities or traveling through regions prone to changing climates. Without adequate insurance, tourists could face high medical costs in the event of illness or injury.

Choosing the Right Travel Insurance for Turkey

Selecting the right Travel Insurance Turkey is crucial to ensuring that you are well-protected during your trip. There are several factors to consider to help you choose the best coverage for your specific needs. Here’s a breakdown of what to look for:

Destination:

The type of locations you plan to visit in Turkey significantly impacts the kind of insurance you need. Turkey offers a range of environments, from bustling cities like Istanbul to remote, rugged regions such as national parks in central Turkey and coastal areas like the Mediterranean and Aegean.

If you’re heading to these more remote or rural areas, it’s important to choose a policy that includes medical evacuations and emergency services. Some policies also cover natural disaster-related incidents like earthquakes, which can be relevant in Turkey’s earthquake-prone regions.

Be sure to check that your policy accounts for the destination’s unique risks.

Activities:

Turkey is known for its rich history and culture, but it also offers a plethora of adventure opportunities, from exploring ancient ruins to adventure tourism activities like hot-air balloon rides over Cappadocia or diving along the Mediterranean coast.

Each activity may carry its own risks, so it’s important to ensure that your Travel Insurance Turkey covers those specific pursuits. If you’re planning to engage in high-risk activities such as paragliding, trekking, or rock climbing, ensure that your policy includes coverage for these adventurous undertakings.

Trip Duration:

The length of your stay also plays a major role in selecting your insurance. If you’re visiting for a short stay, a single-trip insurance policy may be sufficient.

However, for longer stays, or if you plan on traveling to Turkey more than once in a year, it may be more cost-effective to opt for an annual multi-trip policy. An annual plan typically covers multiple trips within a year, allowing you to travel with more flexibility at a lower cost.

Health Considerations:

If you have pre-existing medical conditions or are traveling with elderly family members, you’ll want to ensure your Travel Insurance Turkey includes comprehensive medical coverage. Policies that offer coverage for pre-existing conditions might come with additional costs or require you to disclose your medical history.

Additionally, if you’re traveling with older relatives, make sure the policy offers higher medical limits and coverage for emergencies, including evacuation, which could be necessary if you’re exploring more remote areas like Turkey’s mountainous regions or national parks.

By carefully considering these factors—destination, activities, trip duration, and health considerations—you can select the right Travel Insurance Turkey that offers you the best protection and coverage for your unique travel needs.

How to Compare Insurance Plans

When comparing different insurance policies for Travel Insurance Turkey, it’s essential to look at:

- Coverage Limits: Check what each plan covers, especially medical expenses, lost luggage, and trip cancellations. Some policies may offer higher limits for medical emergencies, which can be crucial if you’re engaging in more high-risk activities.

- Exclusions: Make sure to check exclusions in the insurance policy. For instance, some policies do not cover certain adventure tourism activities or extreme sports, such as bungee jumping or mountaineering, unless explicitly stated.

- Provider Reputation: A well-established insurance company with a good track record will offer better customer service in case of an emergency. Look for reviews, recommendations, and feedback on how well they handle claims.

Top Travel Insurance Providers for Turkey

Several major insurance companies offer Travel Insurance Turkey, providing a variety of coverage options to suit different types of travelers. Popular international providers like Allianz, AXA, and World Nomads are well-regarded for their comprehensive policies and excellent customer service.

These providers offer extensive coverage for medical expenses, trip cancellations, lost baggage, theft, and emergency evacuations, making them ideal choices for tourists seeking reliable protection while in Turkey.

World Nomads, in particular, is favored by adventure travelers due to its tailored coverage for activities like hiking, diving, and skiing, which are popular in Turkey’s diverse landscapes.

In addition to these global providers, several local Turkish insurance companies also offer travel insurance policies specifically designed to meet the needs of tourists visiting Turkey. These policies may be more affordable and offer added benefits such as coverage for issues specific to the region, such as natural disasters or Turkish healthcare services.

Local providers like Anadolu Sigorta and Turkey Travel Insurance ensure that tourists are protected according to Turkish regulations, offering policies that cater to the unique needs of travelers in the country, including options for adventure tourism and more.

Many local providers also offer 24/7 support in multiple languages, making them a convenient option for those who prefer working with a Turkish-based insurer.

Top Rated Hair Transplant Clinics in Istanbul

How to Buy Travel Insurance for Turkey

Online Platforms vs. Offline Insurance Purchase

You can purchase Travel Insurance Turkey either through online platforms or by working with a local agent. Online platforms such as travel insurance comparison websites allow you to compare policies, prices, and coverage options in one place, making it easy to find the best deal. However, local agents can offer tailored advice and assist with any specific requirements related to your travel plans.

What You Should Know Before Buying

Before committing to a policy, ensure you understand all terms and conditions. Look for coverage limits, exclusions, and any specific requirements that may apply to activities like adventure tourism. It’s important to read the fine print and make sure you’re fully covered for the type of trip you’ll be taking.

Step-by-Step Guide to Buying Travel Insurance for Turkey

- Research: Start by researching various providers and policies that are specifically designed for Travel Insurance Turkey.

- Compare: Look for policies that suit your travel needs—whether it’s for short-term medical coverage or adventure activity insurance.

- Choose Your Plan: Pick the plan that offers the best balance of price and coverage.

- Fill Out Application: Complete the application process and submit necessary documents.

- Get Confirmation: After payment, receive your policy and ensure that you have all the documentation needed for your trip.

Understanding Hair Loss

Before you can truly commit to a hair transplant it is important to understand hair loss. Together with the experts at IdealofMeD, we wrote an e-book explaining everything you need to know about hair loss. From hair loss causes to practical tips on how to deal with hair loss and the best hair loss products.

Claims Process for Travel Insurance in Turkey

When Can You File a Claim?

Filing a claim during your trip is essential if you experience any unexpected issues, including medical emergencies, flight cancellations, or lost or stolen belongings. Travel Insurance Turkey is designed to cover a wide range of incidents that could impact your trip.

For example, if you suffer an injury while engaging in adventure tourism activities like hiking or diving, your medical expenses and emergency evacuation costs may be covered.

Similarly, if your souvenirs or valuables are lost or stolen during your time in Turkey, travel insurance can provide compensation. If your flight is delayed or canceled due to weather-related climates, or if an emergency disrupts your trip, you may be entitled to reimbursement for additional expenses.

To file a claim, you’ll need to gather documentation, including medical reports, police reports (for theft or loss of belongings), and receipts for any costs incurred. Promptly reporting incidents is crucial to ensure timely claim processing.

How to File a Claim in Turkey

If you find yourself needing to file a claim, the first step is to contact your insurance provider as soon as possible. Many insurance companies offer 24/7 customer support, which is essential for travelers facing language barriers in Turkey.

This support can help guide you through the claims process, providing instructions in English or other languages as needed. Be prepared to provide specific details about the incident, including the time, location, and any witnesses.

Make sure you document everything carefully, including photos of damage or loss, receipts, and any medical records related to your condition. Most insurers also allow you to file claims online, which can speed up the process.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, organization is key. Always keep a copy of your insurance policy and any important documents, such as receipts, booking confirmations, and medical reports, in a secure location, preferably both digitally and physically.

If you’re claiming for lost or stolen items, make sure to report the theft to local authorities immediately and obtain a police report, as this is often required for reimbursement.

When seeking medical treatment, keep all medical records and receipts, as they will be needed to claim medical expenses. Additionally, be proactive in following up with your insurance provider, checking the status of your claim, and ensuring that all documents have been submitted correctly.

Working closely with your insurer can help avoid unnecessary delays and ensure your claim is processed in a timely manner.

Common Myths About Travel Insurance for Turkey

Myth #1: Travel Insurance is Too Expensive

Travel insurance does not have to break the bank. In fact, many affordable options are available to cover the essentials. With the right research, you can find a policy that offers solid coverage for your needs without overspending.

Myth #2: You Don’t Need Travel Insurance for Short Trips

Even on short trips, Travel Insurance Turkey is still essential. Whether you’re taking a weekend getaway to explore nightlife or embarking on a walking tour, unforeseen incidents like medical emergencies or lost luggage can happen at any time.

Myth #3: Travel Insurance Covers All Types of Risks

Not all travel insurance policies cover every risk. Always check the exclusions section of your policy to ensure it includes coverage for the activities you plan on doing, especially high-risk ones like adventure tourism.

Myth #4: Your Health Insurance at Home Will Cover You Abroad

Domestic health insurance often doesn’t extend to international coverage. Without Travel Insurance Turkey, you could find yourself facing unexpected medical costs that your regular health plan won’t cover.

Final Thoughts

In conclusion, securing Travel Insurance Turkey is a vital part of preparing for your trip. Whether you’re exploring ancient cities, shopping for Turkish souvenirs, hiking through stunning national parks, or enjoying the vibrant nightlife, travel insurance provides essential protection.

It covers a range of potential issues, from medical emergencies to trip cancellations, ensuring that you are not left with unexpected financial burdens.

By understanding your options, comparing plans, and choosing the right coverage for your needs, you can travel with confidence, knowing you’re protected in case of the unexpected.

Travel Insurance Turkey also ensures that you’re covered for activities like adventure tourism, which could present risks while enjoying outdoor adventures like hiking, skiing, or diving.

Moreover, securing insurance before your trip to Turkey can help you avoid unnecessary stress, especially when dealing with unforeseen challenges during your travels.

Don’t leave your trip to chance—make sure you’re covered with the right Travel Insurance Turkey for a worry-free experience that lets you fully enjoy the wonders of this incredible country.

Tom, Lead Clinic

Researcher and Writer

My Final Tips

Tip 1: Skip the long queues and overpriced tours at popular tourist sites. Instead, immerse yourself in the local culture by opting for guided walking tours through neighborhoods like Sultanahmet or Kadıköy to truly connect with Turkey’s history. These tours offer a more personalized, authentic experience.

Pro Move: Ask your guide for hidden gems like local cafés and less-visited spots. You’ll discover parts of Turkey that many tourists overlook, giving you a richer experience at a fraction of the cost.

Tip 2: When it comes to Travel Insurance Turkey, don’t just choose any generic plan. Opt for one that specifically covers activities you’re planning to do, like adventure tourism or hiking in the national parks. A tailor-made policy can save you from unexpected medical or activity-related expenses.

Pro Move: Always double-check coverage for adventure activities. Insurance plans can have different conditions for high-risk activities, so ensure you’re covered before taking the plunge.

I take great pleasure in offering assistance and addressing any inquiries you may have, ensuring that you discover the ultimate guide to Travel Insurance Turkey. Please feel free to reach out to me!